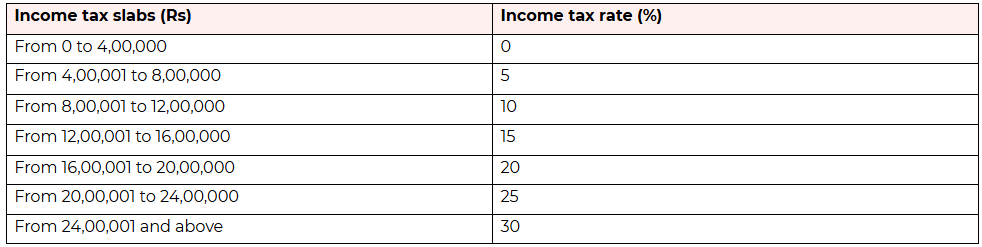

Income tax slabs for FY 2025-26 (AY 2026-27), FY 2024-25 (AY 2025-26), FY 2023-24 (AY 2024-25) under the new tax regime

The new income tax slabs under the new tax regime have been proposed for the upcoming fiscal year 2025-26.

The changes proposed in the income tax slabs under the new tax regime will benefit taxpayers who struggle to save income tax by making savings and investments.

The highest tax rate of 30% is proposed to be applicable on incomes above Rs 24 lakh under the new tax regime as opposed to Rs 15 lakh currently.

Here are the proposed income tax slabs under new tax regime for FY 2025-26 (AY 2026-27)

The changes proposed in the new tax regime will further make the new tax regime more attractive vis-à-vis the old tax regime. In February 2023, the changes were announced in the new tax regime to make it more attractive for individual taxpayers. Some of these changes were – the introduction of the standard deduction, raising the basic exemption limit, a hike in tax rebate under Section 87A for taxable income up to Rs 7 lakh and so on. In the July 2024 budget, the government tweaked the income tax slabs under the new tax regime further. The changes in the income tax slabs in July 2024 budget raised the upper limit in two slabs by Rs 1 lakh. The Rs 3 lakh-Rs 6 lakh slab has become Rs 3 lakh-Rs 7 lakh; and the Rs 6 lakh-Rs 9 lakh slab has become Rs 7 lakh-Rs 10 lakh.

📞 Call now at 7982015606 or visit numericconsultants.in to learn more.